Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Planning your family finances effectively is essential to building a secure and harmonious future together. Family finance planning involves more than just balancing the checkbook—it’s about aligning your financial goals, managing your budget as a couple, and preparing wisely for your children’s future. Whether you’re newlyweds or expanding your family, understanding how to coordinate money matters can reduce stress and empower your financial decisions.

Open and honest conversations about your financial goals are the foundation of effective family finance planning. Discuss priorities like buying a home, saving for your children’s education, or planning for retirement. Using the SMART goals framework (Specific, Measurable, Achievable, Relevant, Time-bound) helps make these goals concrete and trackable.

Pro tip: Schedule a monthly “money date” to review your progress and make adjustments. This approach encourages transparency and teamwork.

(Source: CFPB.gov – Talking About Money as a Family)

Every couple’s financial style is different. Some prefer joint accounts for full transparency, while others combine joint and separate accounts for flexibility. The key is to establish a system built on trust and clear communication.

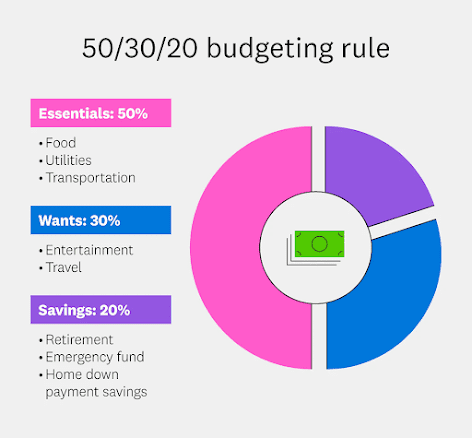

The 50/30/20 budgeting rule is a simple yet powerful guideline: allocate 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. Use budgeting apps or shared spreadsheets to track spending and keep everyone on the same page.

(Source: Investopedia – 50/30/20 Budget Rule)

Education costs can be a major financial challenge. Starting early with a 529 Education Savings Plan can ease this burden while offering tax advantages. You can contribute up to $15,000 per year per beneficiary without gift tax consequences, and earnings grow tax-free when used for qualified education expenses.

(Source: IRS.gov – 529 Plans)

Discuss any existing debts openly and prioritize paying off high-interest debts first. Tackling debt together builds financial confidence and reduces stress.

Aim to save between 3 and 9 months of essential living expenses in an accessible account. This fund will protect your family from unexpected financial shocks like job loss or medical emergencies.

(Source: NerdWallet – Emergency Fund Basics)

Maximize contributions to employer-sponsored retirement accounts, like 401(k)s, and consider opening IRAs to complement your savings. Discuss retirement timelines and lifestyle expectations together to ensure your plans align.

(Source: Fidelity – Retirement Planning for Couples)

Adequate life, health, and disability insurance protect your family’s financial well-being. Updating beneficiaries and creating or updating a will ensures your assets and guardianship wishes are clear.

(Source: USA.gov – Estate Planning)

Introduce children to financial concepts with age-appropriate tools like piggy banks, chore-based allowances, and family savings challenges. There are also many apps designed to help teens learn money management skills.

Life changes—new jobs, babies, moves, or emergencies. Review your family finances at least quarterly and adjust your plan as needed to stay on track.

Family finance planning is an ongoing process that strengthens your partnership and secures your family’s future. By aligning your goals, budgeting smartly, preparing for your children’s education, and planning for emergencies and retirement, you build a resilient financial foundation. Remember, open communication and teamwork are your greatest assets.

Investing in Departing Business Cases in 2025: The Rise of Secondary Private Equity Markets