Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

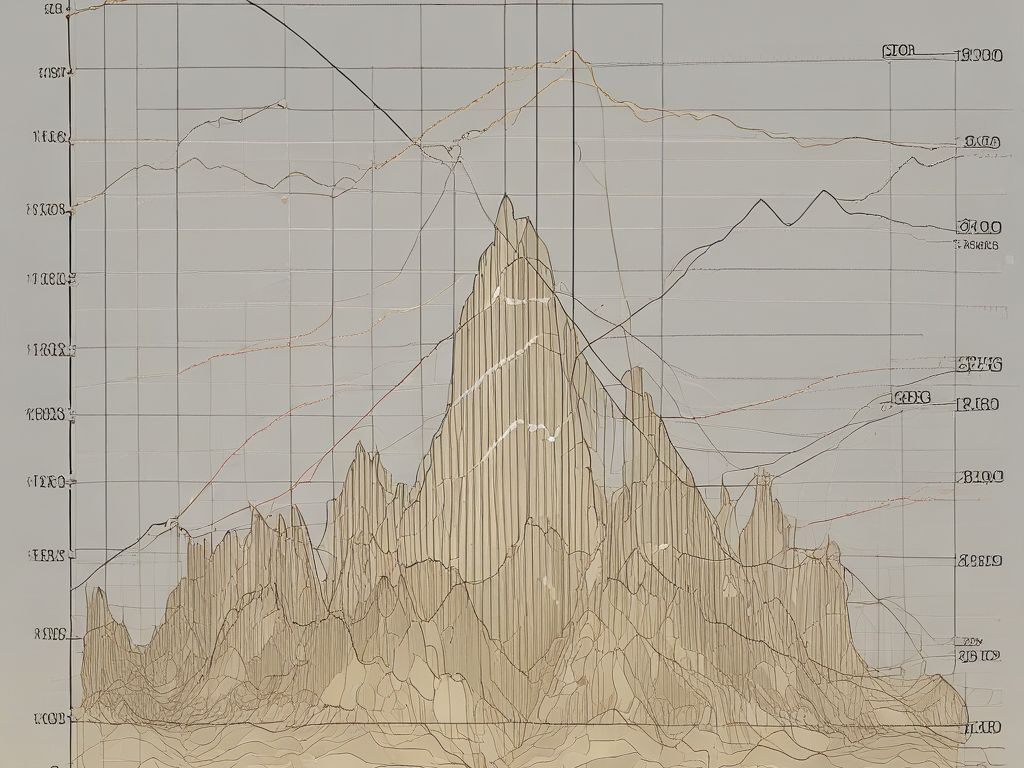

Gold has soared past $3,300 per ounce, breaking record after record in 2025. With robust central bank demand, inflationary pressures, Federal Reserve uncertainty, trade tensions, and geopolitical instability, investors are asking: Is gold just warming up, or is a correction coming?

In this updated gold price forecast 2025, we dig into real-time price trends, forecast future movements into 2026, and reveal what global analysts are signaling for both bulls and bears.

As of July 7, 2025, gold is trading in the $3,320–$3,355 range, maintaining its position near recent record highs. The dramatic growth in 2025 has been driven by multiple global forces:

According to data from Reuters, gold’s recent rally has been among the most sustained in the last two decades, supported by both institutional demand and investor fear of global instability.

Most mainstream analysts project moderate but consistent growth, as central bank accumulation, inflation, and global uncertainty persist.

According to the World Gold Council, central banks acquired over 1,082 tonnes of gold in 2024, and are on track to match or surpass that in 2025. China, India, Turkey, and Brazil are among the most aggressive buyers.

Despite Fed efforts, U.S. core inflation remains above 3.4%. Global inflation averages 5–6%, according to OECD data. This erodes purchasing power and strengthens gold’s safe-haven appeal.

Ongoing tensions in Ukraine, Taiwan, and the Middle East, coupled with rising U.S. debt levels, are creating distrust in global fiat systems. The weakening dollar makes gold even more attractive globally.

While gold ETFs had outflows early in 2025, recent weeks have seen renewed interest. According to WisdomTree, net speculative positions are rising—but not yet at speculative bubble levels.

From $35/oz in the 1970s to over $3,300/oz today, gold has delivered long-term value. During crises—the dot-com bubble, 2008 financial crash, COVID-19, and now the 2020s stagflation era—gold has remained a reliable wealth preserver.

Gold has also outperformed U.S. Treasuries, emerging market debt, and many equity indices over multi-decade timeframes. Its annualized return since 2000 exceeds 9.5%, making it a viable hedge against uncertainty and currency devaluation.

If your portfolio lacks exposure to hard assets, gold remains one of the most strategic allocations:

Even in the bearish scenario, long-term fundamentals remain intact. As always, seek advice from a licensed financial advisor.

What’s up, its pleasant paragraph concerning media print,

we all be familiar with media is a great source of data.