Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Saving money consistently is one of the cornerstones of long-term financial success—but figuring out exactly How Much Should You Save Each Month can feel overwhelming. The ideal amount depends on your age, income, lifestyle, and financial goals.

Whether you’re in your 20s building an emergency fund or in your 50s preparing for retirement, this guide will give you clear monthly savings targets and practical tips to help you stay on track.

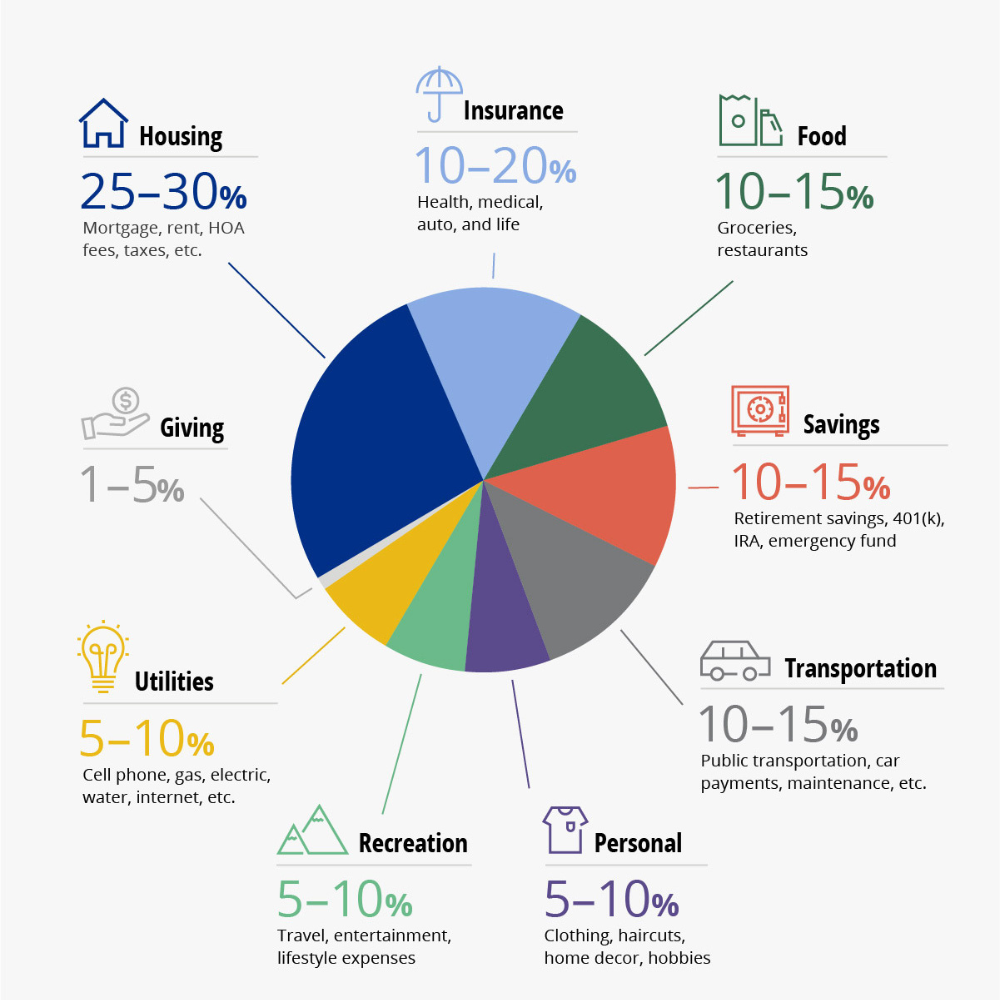

A widely recommended budgeting method is the 50/30/20 rule:

📌 Quick takeaway: Aim to save at least 20% of your net (take-home) income each month. But this is just a baseline. Let’s make it more concrete.

Use the table below to set a realistic savings target based on your current age group and annual income. These figures combine short-term savings (like emergency funds) with long-term investments (like retirement plans).

| Age Group | Annual Income | Suggested Monthly Savings | Notes |

|---|---|---|---|

| 20–29 | $30,000 | $250–$500 | Focus on building emergency fund and paying off high-interest debt. |

| 20–29 | $50,000 | $400–$800 | Start investing in a Roth IRA or similar retirement account. |

| 30–39 | $50,000 | $800–$1,000 | Grow retirement savings, maintain 3–6 months of emergency fund. |

| 30–39 | $70,000 | $1,200–$1,400 | Consider maxing out your 401(k) employer match. |

| 40–49 | $70,000 | $1,400–$1,800 | Increase contributions if you’re behind on retirement goals. |

| 40–49 | $100,000 | $1,800–$2,200 | Add college savings if applicable. |

| 50–59 | $100,000 | $2,000–$2,500 | Use catch-up contributions for IRA/401(k). |

| 60+ | Any | Varies | Focus on asset protection and managing retirement income. |

Source:

The table above is a great starting point, but your real savings goal depends on you. Here’s how to build your own plan:

The first step in determining how much to save each month is identifying exactly what you’re saving for. Are you building an emergency fund, planning for retirement through a 401(k) or IRA, or preparing for a major purchase like a house, wedding, or dream vacation? Write down your goals and rank them by priority. Having clear objectives helps you figure out how much you need to save—and by when.

Understanding where your money goes each month is crucial. Track your fixed expenses (like rent, utilities, debt payments) and your variable ones (like groceries, entertainment, and dining out). Use budgeting apps like Mint, YNAB (You Need A Budget), or a simple spreadsheet to categorize your spending. This insight helps you identify areas to cut back and reallocate money toward savings.

One of the most effective ways to build a consistent saving habit is automation. Set up an automatic transfer from your checking account to a savings or investment account right after payday. By treating saving as a non-negotiable “expense,” you remove the temptation to spend first. Even small automated amounts can grow significantly over time thanks to compound interest.

Life isn’t static—your savings strategy shouldn’t be either. Did you get a raise? Consider increasing your monthly savings rate. Have a new baby or take on a mortgage? You may need to shift priorities and reevaluate your budget. Revisit your savings goals regularly—at least once a year or after major life events—to make sure you’re staying on track and adapting to real-life changes.

It’s okay. Not everyone can save 20% right away. The key is to start small and build momentum.

✅ Try this:

💡 Consistency is more important than perfection.

There’s no one-size-fits-all number for saving money—but a clear target based on age, income, and financial goals is the best place to start. Even small contributions today can lead to major progress tomorrow.

Whether you’re saving $50 or $500 a month, what matters most is that you start and stay consistent.

👉 10 Essential Tips for Achieving Financial Success

Take the next step in your financial journey with more actionable advice on saving, investing, and budgeting!