Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

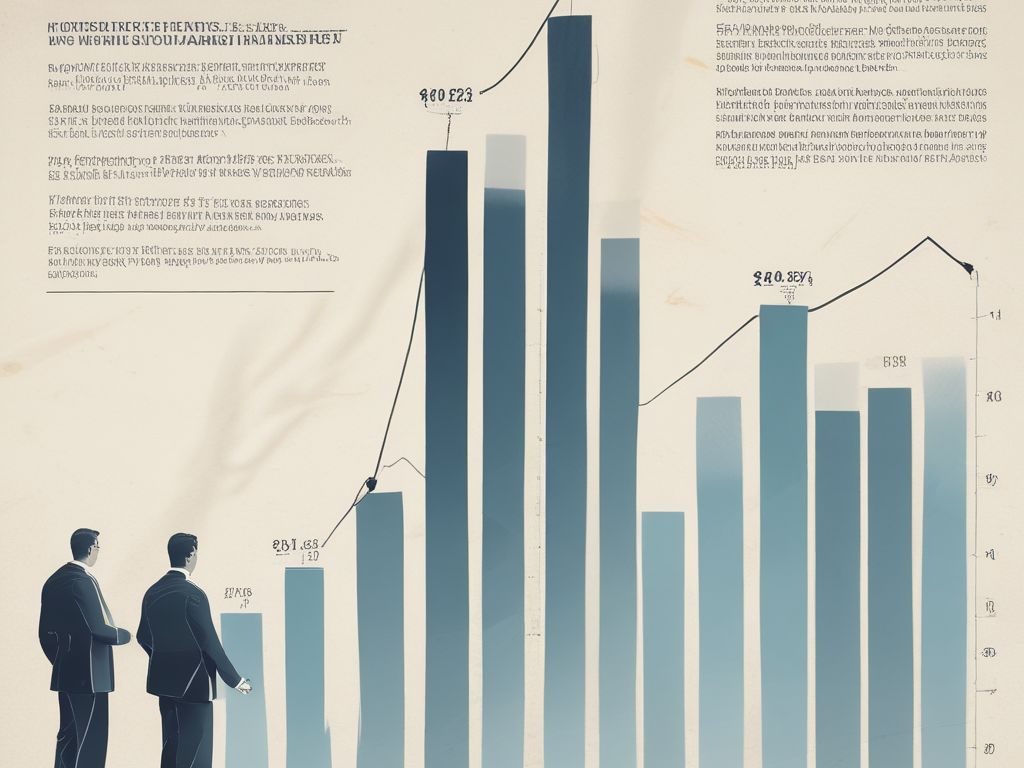

The secondary private equity market is gaining real momentum. Instead of backing new funds, investors are picking up stakes in existing ones—often at a discount—which makes it a smart way to spread risk. With higher interest rates, tighter liquidity, and uncertain exits, secondaries look more attractive than ever.

By 2025, deal volume is expected to reach around $140 billion, up from about $112 billion in 2023—clear proof that this corner of private equity is becoming too big to ignore.

Secondary deals—where investors trade stakes in existing private equity funds—have been around since the late 1970s, but they’ve taken off in a big way over the past 20 years. Today, this market has become a core part of private equity, according to Prequin.

Since 2021, global deal volumes have consistently stayed above $100 billion a year, with growth showing no signs of slowing. In 2023 alone, transactions hit about $112 billion, up 4% from the year before, according to Jefferies. What’s fueling this? On one side, limited partners want quicker access to liquidity; on the other, general partners are finding creative ways to use secondaries to manage their portfolios.

McKinsey & Company have reported that Private equity funds today control more than $3 trillion in assets worldwide, invested in over 26,000 companies. What’s striking is that about a quarter of those investments have been sitting still for more than six years—longer than usual, which means many of them are ready to be sold.

The problem? The current economy isn’t making it easy. With interest rates high and cash harder to come by, the usual ways of selling—like mergers, acquisitions, or IPOs—have slowed down dramatically. Compared to the boom in 2021, investments are down by about 60%, and exits have fallen even more, around 70%.

Faced with these challenges, investors are looking for other ways to free up their money. One solution that’s gaining ground is the secondary market, where investors can sell stakes in funds to others instead of waiting for a traditional exit. And while things are still moving slower than a few years ago, early signs in 2025 suggest the market is slowly getting back on its feet.

Secondary private equity has been getting a lot of attention lately, especially when the market feels a bit shaky. Here’s why more and more investors are jumping on board:

Get in at a Better Price: One of the biggest draws is that secondary stakes often go for less than their current net asset value (NAV). Basically, you’re not paying full price upfront, which cuts down your risk and can boost your returns. Sellers are usually in a hurry to get cash, so savvy buyers can snag a good deal.

Instant Diversification: Buying secondary funds gives you exposure to a mix of investments right away—different years, regions, sectors, and strategies. Think of it like spreading your bets without having to wait years for the fund to grow.

See Returns Sooner: Since these funds are already in motion, your money starts working faster. You skip the painful early years of the typical private equity “J-curve” and can start seeing results sooner rather than later.

No Surprises: One of the best things? You actually know what you’re buying. Unlike primary funds, where you throw money into a “black box,” secondary deals let you peek inside the portfolio. That makes it way easier to manage risk.

Potential for Better Gains: Buying at a discount and investing in funds that are already maturing can lead to stronger returns than going the traditional route. It’s like catching the wave a little later but riding it harder.

According to Arcano Partners, a firm that specializes in secondary private equity, these perks—along with rising interest rates and tighter liquidity—are making secondary markets hotter than ever. Fund managers are also getting creative with GP-led deals to give investors cash while still keeping a handle on their assets.

If you’re looking to get into secondary private equity this year, there are a few ways to do it without getting lost in the jargon:

And here’s a cool part: secondary private equity is becoming easier to access even through self-directed retirement accounts, like IRAs or solo 401(k)s. That means individual investors can branch out beyond the usual stocks and bonds while still potentially taking advantage of tax-friendly growth.

The future looks bright for secondary private equity. According to research by PitchBook, even with the ups and downs of the global economy and some regulatory hurdles, secondary market activity is expected to hit record levels in 2025.

Rising interest rates are making the usual private equity exit routes a bit tougher, which is why finding alternative ways to access liquidity is more important than ever. As more investors look to rebalance their portfolios and fund managers get creative with new fund structures, the secondary market is stepping up as a major player in private equity investing.

The secondary private equity market in 2025 is shaping up to be a really interesting opportunity for anyone looking to mix things up, reduce risk, and potentially earn better returns. Buying stakes in mature funds at discounted prices can shorten your investment timeline and give you access to a wide variety of private equity assets.

That said, this isn’t a “set it and forget it” kind of deal. It’s a bit complex and calls for some careful research. But the rewards can be worth it, especially with rising interest rates and liquidity pressures making the usual markets a bit trickier to navigate.

On top of that, with easier access through self-directed retirement accounts and specialized secondary funds, more investors than ever can join the party.

If you want to branch out beyond regular stocks and bonds, getting a handle on secondary private equity is key. For a closer look at alternative strategies and ways to diversify your portfolio, check out our full guide on alternative investments in 2025.

Your Ultimate Guide to Alternative Investments in 2025: Diversify and Grow Your Wealth